You can't avoid property taxes as a homeowner. They're not just as certain as death as the saying goes.

Don't fret though because I'm going to show you how to assess property taxes in Knoxville TN. It's actually quite simple and as long as you can do some division, multiplication, and understand a few things about your property, you can easily do it on a scratch piece of paper. So no need for a property tax calculator.

Before we jump into the definitions and math, you can check out my other YouTube video, 7 Ways to Save Money on Your Knoxville Property Taxes here.

Let's get started...

Definitions

The first thing you need to know is the definitions of the terms used in assessing Knoxville property taxes. There are basically four things you need to know before you can do the math.

Property Appraised Value

The assessed value is what your home is worth. If you bought your home for sale in Knoxville then you have that number. For our example, let's say your Knoxville home was for sale at $100,000 and you paid that for it.

Assessment Ratio

The assessment ratio is a percentage that Knox County uses to base the tax charges on. It's 25% of the assessed value for residential and farm properties and 40% for industrial and commercial properties. For our home - being that it's a residential home - we'll use 25%. *

Note: This is a big part of what makes Tennessee property taxes so cheap. Instead of a home being taxed on the full value, it's only being assessed on 25% of it. The next item is also a big factor.

Assessed Value

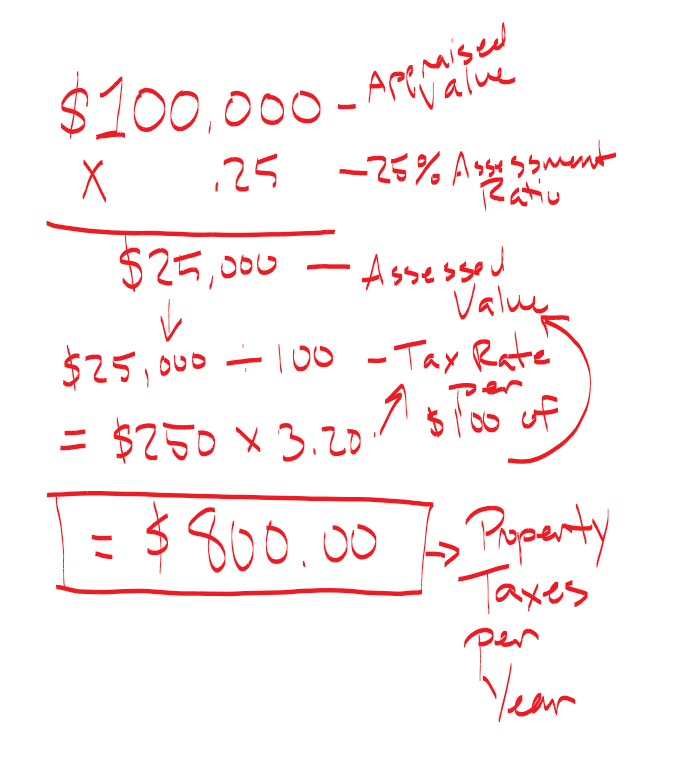

This is going to be the value after taking the Assessment Ratio and multiplying that by the Appraised Value. In our example, this will be $25,000, or, $100,000 x 25% (.25) = 25,000.

Tax Rate

The tax rate is different per county when used to assess property taxes. For Knox County, it's 3.20 per every $100 of the assessed value after the assessment ratio. Yeah, I know...it's starting to get a little complicated but bear with me. First, the tax rate is figured based on the need of the county. The more the county offers to the public like roads, public services, etc., the higher the tax rate.

The rest I'll show you in the math.

The Math

Let's put this all together

If you can make sense of the chicken scratch above, you can see that the property taxes for a $100,000 home is $800 a year based on the Knoxville Tax Assessment ratio. I hope you found this helpful.

Remember, if you ever need anything from me, whether it's to buy or sell a home or you just want some information on the market, please do not hesitate to contact me. Just click HERE and fill out the form.

*After writing this blog I checked the Knox County Government Assessors website and the residential Tax Assessment Ratio is actually 30%, not 25%. So just replace the .25 in your math with .30 or simple .3